Under the Economic Substance Regulations (“ESR“) most UAE businesses need to prove to the UAE authorities that they are doing business in the UAE (have an “economic substance”). The ESR were implemented to avoid harmful tax practices within the UAE.

As the ESR have substantially changed in August 2020, all UAE businesses should now re-assess their legal obligations. The first official deadlines end on 31 December 2020.

What you need to know: The key takeaways

The ESR apply to companies which are registered and licensed in the UAE (including free zone and offshore companies) and are active in one of the following business areas (= relevant activity): banking, insurance, investment fund management, lease-finance, headquarters, shipping, holding company, intellectual property, and distribution and service centre business.

- First thing to do: If your company carries out a relevant activity, you need to notify the authorities within 6 months from the end of your financial year about your business activities in the UAE (notification obligation). E.g., if your financial year ends on 31 December 2020, you need to submit the notification until 30 June 2021.

IMPORTANT: All notifications for the last financial year need to be re-submitted using the new online portal until 31 December 2020. This must be done even if you have already sent a notification to the regulatory authorities this year under the old deadline. Also, if you have ignored the deadline so far.

- Second thing to do: If there is no exemption for your business (check out our summary below) and you generate income from a relevant activity, you also need to prove to the UAE authorities that you actually have an economic substance in the UAE. This means that within 12 months from the end of your financial year, you need to submit a report on your economic substance within the UAE (= reporting obligation). Therefore, the first official deadline for reports ends on 31 December 2020.

- The notification and the report must be submitted electronically via the online portal of the Ministry of Finance.

- If you do not comply with the 31 December deadline, you will be fined AED 20,000 or AED 50,000 (depending on the violation). Higher fines of up to AED 400,000 can be imposed for continuous violations.

Please find the verbal summary under the following Link. We are available and happy to assist you with any potential questions and concerns. For further information about the new ESR check out our more detailed summary on the following pages.

The new ESR: A closer look

What are the Economic Substance Regulations?

The ESR aim to prevent harmful tax practices in the UAE. Following international standards, no country should facilitate structures or arrangements with the purpose of attracting profits which do not reflect real economic activity. The ESR were introduced in in 2019 and substantially revised in August 2020 (Cabinet Resolution No. 57/2020 and Ministerial Decision No. 100/200).

Do the ESR apply to my UAE business?

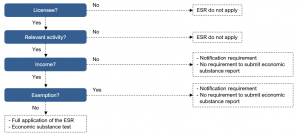

The ESR apply to (i) legal entities which are licensed in the UAE, (ii) carry out a relevant activity, (iii) generate relevant income, and (iv) are not exempted from the ESR:

- Licensee: A juridical person (limited liability company, private shareholding company, public shareholding company, joint venture company) or an unincorporated partnership registered and licensed in the UAE. Licensees include free zone and financial free zone companies, offshore companies and branches of foreign companies. Natural persons, sole proprietors, trusts, and foundations are now excluded from the ESR.

- Relevant activities: Banking, insurance, investment fund management, lease-finance, headquarters, shipping, holding company, intellectual property, and distribution and service centre business. More detailed information can be found in Schedule 1 of the Ministerial Decision No. 100/2020. A ‘substance over form’ applies and the activities actually undertaken are relevant, even if these activities are not covered by the scope of the license.

- Relevant income: The licensee must generate relevant income from a relevant activity. Under the ESR this includes the entity’s entire gross income irrespective of whether it was earned in the UAE or outside the UAE and irrespective of whether a profit or loss was made.

Exemptions: Certain licensees are excluded from the requirement to meet the economic substance test: investment funds, entities which are tax resident outside the UAE, branches of foreign companies where the relevant income is subject to tax outside the UAE, and certain companies owned by UAE residents.

What are my responsibilities under the ESR?

Licensees carrying out a relevant activity are obliged to (i) file a notification and/or (ii) a report:

- All licensees carrying out a relevant activity must submit a notification containing initial information about the licensee.

- Additionally, all licensees which are not exempted from the ESR and generate relevant income must submit an economic substance report containing detailed information about the licensee, its relevant and core income generating activities, and its infrastructure in the UAE. Based on this report, the Federal Tax Authority will assess whether licensees have adequate economic substance within the UAE.

NOTE: Even if licensees are exempted from the ESR or do not generate relevant income, they must still submit a notification if they carry out a relevant activity.

Licensees carrying out a relevant activity are obliged to (i) file a notification and/or (ii) a report:

- All licensees carrying out a relevant activity must submit a notification containing initial information about the licensee.

- Additionally, all licensees which are not exempted from the ESR and generate relevant income must submit an economic substance report containing detailed information about the licensee, its relevant and core income generating activities, and its infrastructure in the UAE. Based on this report, the Federal Tax Authority will assess whether licensees have adequate economic substance within the UAE.

NOTE: Even if licensees are exempted from the ESR or do not generate relevant income, they must still submit a notification if they carry out a relevant activity.

How does the notification and reporting process work?

The notification and reporting process has been centralized with the recent changes to the ESR. Under the new ESR, licensees must submit notifications and reports electronically via an online portal of the Ministry of Finance. The portal was established recently and went live last week. Notifications must be submitted within 6 months and the economic substance report must be submitted within 12 months from the end of the licensee’s financial year. The notification and the report must be submitted annually.

NOTE: Licensees having already submitted a notification to the regulatory authorities for the last year, need to re-submit their notification using the Ministry of Finance’s online portal. The first official deadline for notifications and reports is 31 December 2020.

What happens if I do not comply with the ESR?

With the recent changes to the ESR penalties for non-compliance have been increased, starting from AED 20,000 (failure to submit notification) to AED 50,000 (failure to submit economic substance report or failure to prove economic substance). For continuous infringements, the UAE authorities might impose higher penalties of up to AED 400,000 or more severe sanctions such as the withdrawal of licenses.

Yours truly,

| Dr. Theodor Strohal Senior Partner T: +66 82 905 8469 F: +971 7 23 64 531 E: tstrohal@slglaw.cc www.slglaw.cc |

Jakob Kisser Managing Director UAE T: +971 50 855 8031 F: +971 7 23 64 531 E: jkisser@slglaw.cc www.slglaw.cc |

STROHAL LEGAL CONSULTANTS Villa 2, 20b Street, Community 153 P.O. Box 31484, Ras Al Khaimah UAE Tel: +971 7 236 4530 Mobile: +971 503 765847 E: office@slglaw.cc www.slglaw.cc |